For the second year in a row, we’re offering a pension buyback opportunity, which is your chance to increase your lifetime pension with Medicus.

“I often meet with physicians who worry that it’s too late to join a pension plan or to benefit from one. That’s why I’m so excited about Medicus’ buyback feature, which gives our members a chance to catch up and boost their pension. While some physicians join Medicus early in their careers, others join in their 50s and even in their mid-to-late 60s. Buying back service lets our members build a bigger pension and secure more income for their future.” Simone Reitzes, Managing Director, Medicus Pension Plan.

What is a buyback?

If you worked as an incorporated physician before joining Medicus, you will have periods when you weren’t contributing to or earning a pension. A buyback lets you fill those gaps by making a one-time transfer of money into the plan – using your RRSPs and, in some cases, other personal or corporate savings. The result? A bigger pension that more accurately reflects the years you’ve practised as a physician.

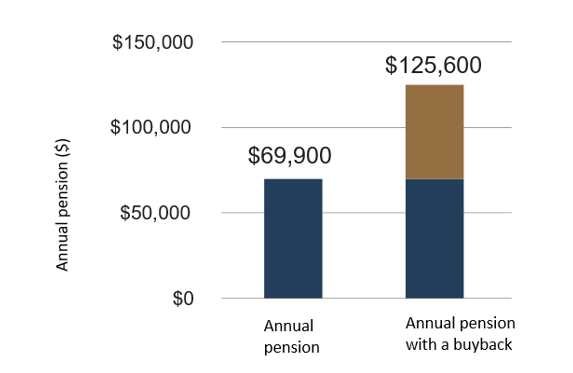

For example, Dr. Joanna practised for 20 years before joining Medicus. She can significantly boost her annual Medicus pension by buying back some or all of that incorporated service.

Dr. Joanna’s annual pension: before and after buying back service

Why buy back?

A wide range of physicians can benefit from buying back service, whether new to practice, nearing retirement, or somewhere in between. Consider the advantages of buying back:

- Maximize your pension and enjoy a larger secure, predictable monthly retirement income that’s paid for life.

- Protect your loved ones: A larger pension means more financial security for your spouse or chosen beneficiaries.

- Simplify retirement planning by spending less time managing investments, with more peace of mind knowing more of your retirement savings are fixed and predictable.

- Diversify your savings with a balance of predictable income (your Medicus pension) and flexible savings (e.g., an RRSP) – and benefit from tax advantages, too.

How to buy back

If you’d like to complete a pension buyback this year, you need to be enrolled in the Medicus Pension Plan by June 30, 2025.

All eligible members will be invited to apply for a buyback. Once you express interest, we will send you an application form along with a Pension Buyback Guide, which explains the process step by step. Plus, our team will be available to answer any questions you may have along the way.

After reviewing the documents, you can submit your application form. You’ll then receive a Buyback Option Package that outlines the periods you’re eligible to buy back and the cost of each option. From there, you’ll have time to consult with any of your trusted advisors and then choose your preferred option and complete the fund transfer – it’s that easy.